Our Understanding Insurance section is Packed with Informative Articles

Understanding Insurance

How Auto Insurance Works in No Fault States

Understanding what is covered by auto insurance within your...

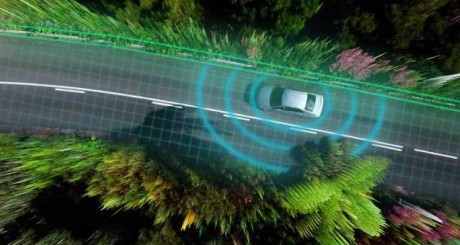

Usage Based Insurance - Everything You Need to Know

In the evolving world of auto insurance, the digital...

Pagination

The materials available in the Knowledge Center are for informational purposes only and not for the purpose of providing legal advice. You should contact legal counsel to obtain advice with respect to any particular issue or problem. Use of this website or any of the links contained within the website do not create representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.