Starting and running a small business involves numerous decisions and responsibilities. One crucial aspect often overlooked is the need for commercial auto insurance. This specialized insurance should be an essential factor that helps protect your business assets and allows you to comply with legal requirements. Certain types of auto usage are not covered by personal vehicle insurance, and with the following information, you will understand why commercial auto insurance should be at the top of your list.

What is Commercial Auto Insurance?

Commercial auto insurance is a policy designed to help pay for damages to cars used for business purposes that are involved in a car accident, where personal auto insurance covers private vehicle use. Business use can include a wide range of activities, from delivering goods to transporting tools or employees.

Business owners often use vehicles as part of their daily operations. Whether it’s a delivery van, truck or a car, these vehicles are integral to the business's success. Commercial auto insurance is important because it offers specialized coverage that helps to pay for damages to these vehicles and the assets it transports from risks that are not typically covered under personal auto insurance. This can include higher liability limits, protection for business-related equipment, and coverage for employees who drive the vehicles.

Do I Need Commercial Auto Insurance?

If you use your vehicle for business purposes beyond commuting to and from work, you may likely need this coverage. This includes using the vehicle to transport goods, visit clients, or if the vehicle is registered to the business.

Get A Commercial Auto Quote Now

List of Businesses that Typically Require Commercial Auto Insurance

Certain types of businesses are more likely to require commercial auto insurance, including:

- Delivery services (e.g., food delivery, courier services)

- Construction and contracting companies

- House painters

- HVAC repair businesses

- Mobile car detailers

- Landscaping businesses

- Cleaning services

- Carpet cleaners

Is Commercial Auto Insurance Required?

In many jurisdictions, commercial auto insurance is a legal requirement for businesses that use vehicles in their operations. Even in areas where it’s not mandated, having commercial auto insurance is highly advisable to help mitigate the financial risks associated with accidents, damage, and liability.

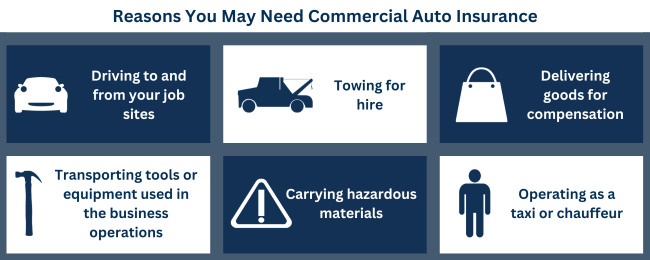

Explanation of the types of business activities that would most likely require commercial auto insurance and activities that would most likely NOT require commercial auto insurance.

Would Require:

- Businesses that transport goods for a fee

- Companies with vehicles that carry heavy equipment or tools to job sites

- Businesses that regularly use vehicles to visit job sites, clients, or vendors

- Firms that have employees driving company vehicles

Would NOT Require:

- Businesses with no vehicular operations

- Sole proprietors who use personal vehicles only for commuting

- Freelancers working from home without the need for transporting goods

What does a commercial auto policy cover?

A commercial auto insurance policy can include several key types of coverage:

- Personal Injury Protection (PIP): Helps to pay for medical expenses for you and your passengers in the event of an accident, regardless of who is at fault.

- Collision Coverage: Helps pay for damage to your vehicle resulting from a collision with another vehicle or object.

- Comprehensive Coverage: Helps to pay for damages caused from non-collision-related incidents, such as theft, vandalism, or natural disasters.

- Rental Reimbursement: Helps to pay the cost of renting a vehicle while your business vehicle is being repaired after an accident.

- Liability Coverage: Helps to pay for damages involving your business’ financial loss if you or an employee are found at fault in an accident that causes injury or property damage to others.

- Trailer Insurance: Helps to pay for damages to your trailer that is attached to your business vehicle.

Benefits of Commercial Auto Insurance

- Comparable Rates: Despite the broader coverage, commercial auto insurance policies can be competitively priced, especially when considering the significant financial protection they offer.

- Added Value: Commercial policies often include added benefits like rental reimbursement, which can save your business money and minimize downtime.

- Broader Coverage: Commercial auto insurance policies are designed to cover a wider range of risks associated with business operations, offering more comprehensive protection compared to personal auto policies.

Commercial vs. Personal Use

Understanding the difference between commercial and personal vehicle use is crucial for determining the right insurance coverage. You can read more about the differences between commercial auto insurance and personal auto insurance.

Commercial Use Activities:

- Transporting goods or merchandise

- Driving to multiple work sites or client locations

- Delivering products to customers

- Using a vehicle for rideshare or taxi services

- Hauling tools, equipment, or hazardous materials

Personal Use Activities:

- Commuting to and from a single workplace

- Running personal errands

- Vacation travel

- Driving children to school or activities

- Occasional long-distance travel for leisure

For business owners, commercial auto insurance is not just a regulatory requirement but a crucial tool to help business operations during unexpected events. It offers broader and more specialized coverage than personal auto insurance, helping to protect the business from significant financial loss due to accidents, theft, or damage. By understanding the specific needs of your business and the types of activities that require commercial auto insurance, you can verify that your vehicles and your business are adequately insured. Investing in commercial auto insurance is a smart move that provides peace of mind and helps with your financial security, allowing you to focus on growing your business.

Get A Commercial Auto Quote Now